Jodie L. Ferguson, Ph.D.

-Jodie L. Ferguson, Ph.D., Chapter 11 Author

INTRODUCTION

What is price? Most of the time we think about price being money or credit in exchange for a product. Price includes the number of monetary units which a buyer must hand over for one unit of a product (Simon and Fassnacht 2019). So money is definitely one form of price, but there are others. The time and effort involved in coming to the table for the exchange could also be considered part of the price. For example, if a buyer is interested in purchasing a new smartphone, they might have to drive to the store, park their car, talk with a sales representative to learn about various smartphone item options, wait for customer service at the cashier, and go through the set-up procedures with the new phone. All of this time and effort is considered part of the price of acquiring the new phone.

Price is one of the cornerstones of the marketing mix. To the untrained eye, price may simply be seen as the asking price a seller sets to cover their costs plus a profit. In many cases this is true, but pricing is much more! Pricing can be a way to convey the quality of a product, to entice a buyer to make an impulse purchase, or even to switch brands altogether. pricing can include the buyer in the marketing process through negotiations or auctions, for example.

TWO DETERMINANTS OF PRICE

There are two main determinants of price: cost and demand (Lamb, Hair, McDaniel 2020). The cost determinant takes into consideration the costs incurred by the seller in setting the price. The demand determinant, on the other hand, considers what the target market is willing to buy at various price points.

For example, imagine a person wants to sell their house. They might think of all of the costs that went into the house: the mortgage, the original down-payment, any improvements done to the house, etc., and set a price above the costs paid. This strategy would be consistent with the cost determinant of price. Or, the seller may look at comparable house sales in their neighborhood, taking into consideration which houses have the same number of bedrooms, bathrooms, square feet, etc., and they would  set a price consistent with the comparable homes’ prices. Using comparable houses to set the price would be considered the demand determinant of price. Ideally, marketers would consider both costs and demand determinants in setting price. However, given constraints or circumstances, the cost or demand determinant may be dominant.

set a price consistent with the comparable homes’ prices. Using comparable houses to set the price would be considered the demand determinant of price. Ideally, marketers would consider both costs and demand determinants in setting price. However, given constraints or circumstances, the cost or demand determinant may be dominant.

i.) The Cost Determinant

The cost determinant considers fixed costs, variable costs and total costs as the base for setting price. Typically, the price is set at a point that is above the total costs in order to realize a profit.

Fixed costs are costs that do not change with unit output, while variable costs are costs that do change with unit output.

Total variable costs = variable cost per unit × number of units

Total costs are calculated by adding fixed costs and variable costs.

Total costs = fixed costs + variable costs

The break-even price point occurs when the total costs equal the total revenue. Units sold beyond the break-even volume result in a profit, and units sold less than the break-even volume results in a loss.

Break even volume = fixed costs / (price – variable cost)

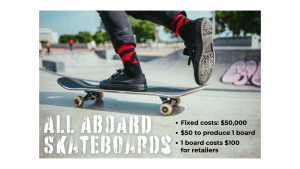

Let’s work out an example. Imagine that a small manufacturer named “All Aboard Skateboards” produces skateboards and sells them to extreme sports retailers. AAS’s fixed costs are $50,000. It costs $50 to produce one skateboard. What would be the break-even volume if AAS sells each skateboard to retailers for $100 each?

Solution:

break even volume = fixed costs / (price – variable cost)

break even volume = $50,000 / ($100 – $50)

break even volume = 1,000 skateboards

This means that AAS will break even if 1,000 skateboards are sold at a price of $100, variable cost of $50, and fixed costs of $50,000. If AAS sells more than 1,000 skateboards it will realize a profit. If AAS sells less than 1,000 skateboards it will realize a loss.

Total revenue is the amount coming into the firm when considering the price and the number of units sold.

Total revenue = price x number of units

After taking into consideration the total costs, including the fixed costs and the variable costs to produce the units sold, the remaining balance from the revenue brought in is the profit (Simon and Fassnacht (2019).

Profit = total revenue – total costs

The contribution margin is the share of the price that adds to profit (Nagle and Holden 2002). In other words, the contribution margin is the share of the price that exceeds the incremental, variable costs.

Contribution margin = price – variable cost

Continuing with our skateboards example, if AAS has fixed costs of $50,000, produces one skateboard for a cost of $50, charges retailers $100 per skateboard, and sells 3,500 units, how much revenue will AAS realize? How much profit or loss? And what will be the contribution margin?

Revenue solution:

total revenue = price x number of units

total revenue = $100 x 3,500

total revenue = $350,000

Profit solution:

profit = total revenue – total costs

profit = $350,000 – ($50,000 + ($50 x 3,500))

profit = $125,000

Contribution margin solution:

contribution margin = price – variable cost

contribution margin = $100 – $50

contribution margin = $50

Considering fixed costs ($50,000), variable cost per skateboard ($50), price ($100), and number of skateboards sold (3,500), AAS will bring in $350,000 in revenue. After considering total costs, AAS will realize a profit of $125,000. The contribution margin, or the amount each additional skateboard sold adds to profit, is $50.

ii.) The Demand Determinant

While the cost determinant takes into account the amount of money going out from the firm when setting the price, the demand determinant takes into account what the target market is willing to pay for the product offering when setting the price. Demand is the number of units the market will buy at given price points within a time period (Armstrong and Kotler 2020). The typical demand curve slopes from upper left to lower right. The figure below displays a conventional demand curve for a t-shirt producer.. When the t-shirts are sold for $45 each, the resulting quantity sold is 800 t-shirts. However, if the price is lowered to $40 each, the quantity goes up to 1,000 t-shirts sold.

Elasticity of demand is a measure of the extent of change in demand given a change in price. If there is little to no change in quantity sold when the price changes, the demand is inelastic. However, if there is a big change in quantity sold when the price changes, the demand is elastic. Products that are commodities or necessities such as milk and toilet paper typically have more inelastic demands, while products that are luxury or non-necessity purchases such as jewelry and vacations tend to have more elastic demands.

COMMON PRICE SETTING STRATEGIES

Some pricing strategies have been successful at meeting marketing objectives. At the simplest level, cost plus, or markup pricing, is when the marketer considers the costs to make the product available to the customer and adds a mark-up value when setting the final price.

When a product is first introduced to the marketplace, marketers often use one of two pricing strategies: price skimming or penetration pricing. Price skimming occurs when the marketer sets the price high when a product is first introduced to capitalize on customers who want the product as soon as it hits the market. Then after the product is in the market for a while, the price is lowered. We see price skimming used frequently with technology products. Penetration pricing, on the other hand, occurs when the marketer sets the price low when a product is first introduced to get people to try the product before the price is raised to its regular price. We see penetration pricing used with convenience type products that are relatively low-priced and are easily sampled.

Captive pricing is a situation in which the base product is relatively inexpensive, however, supplementary or replacement parts need to be purchased in order for the product to work. An example of captive pricing is razors. The handle of the razor might be offered at a generous price, however, the replacement blades for the razor are relatively more expensive. Once the consumer invests in the razor handle, they are held “captive” to purchase the replacement razor blades.

Captive pricing is a situation in which the base product is relatively inexpensive, however, supplementary or replacement parts need to be purchased in order for the product to work. An example of captive pricing is razors. The handle of the razor might be offered at a generous price, however, the replacement blades for the razor are relatively more expensive. Once the consumer invests in the razor handle, they are held “captive” to purchase the replacement razor blades.

DYNAMIC PRICING

The proliferation of technology at marketers’ fingertips has made dynamic pricing a mainstay in the marketplace. Dynamic pricing refers to prices that change and are not constant over a period of time. Think about an online shopping experience. One day the price for a pair of sneakers may be $200, and a few days later the price changes to $215. A few more days later the price drops to $195. Dynamic pricing allows for these price changes based on many different variables, including changing market demand, changing seller costs, inventory availability, and user characteristics. Dynamic pricing allows the seller to make these sometimes very subtle changes in price to maximize profits as the market allows.

PRICE AND THE MARKETING MIX

Price changes based on the product life cycle stage. In the introductory stage, price may be higher in efforts to recoup some of the R&D costs. In the growth stage, the price may drop some with the introduction of competitors and greater reach into channels to distribute product. The price continues to drop into the maturity stage where there are a lot more competitors and product is available in many outlets. Finally, the price bottoms out in the decline stage. Price is a determining factor in the type of product. A product at a very low price point is more likely to be a convenience product than a shopping or unsought product, while a specialty product is more likely to have a high price point.

The place “P” of the marketing mix has an impact on the price set. If there are many intermediaries (e.g., wholesalers, distributors, retailers) between the finished product and the end user, the price is likely to be higher, given that each intermediary in the link will add a percentage mark-up to the final price. In addition, there are economies of scale in that the greater the reach the product has, the less the price will be. The outlet the product is available at also affects price. A smaller convenience store with few options for products may charge a higher price for the same product found in a discount store or grocery store, where many varieties and brand options exist.

Another example of retailer influence on price is a phenomenon called prestige pricing, where a product is priced purposefully higher to elicit perceptions of extremely high quality or luxury. An example of prestige pricing is Tiffany’s jewelry pricing. The retailer, brand, and blue box are indicators of superior quality and the price reflects that.

Another example of retailer influence on price is a phenomenon called prestige pricing, where a product is priced purposefully higher to elicit perceptions of extremely high quality or luxury. An example of prestige pricing is Tiffany’s jewelry pricing. The retailer, brand, and blue box are indicators of superior quality and the price reflects that.

Promotion and price go hand in hand because many times the promotional message involves the price itself. The communication may be about a change in price or a set price. Sales promotion, especially, many times has a link to price. For example, there are sales promotion tactics such as couponing, volume discounts, price bundling, free samples that all involve the price to some extent.

SUMMARY

Price is a crucial part of the marketing mix; after all, it is the only “P” that produces revenue (Armstrong and Kotler 2020)! All other elements of the marketing mix represent costs. Therefore, marketers should carefully consider costs, demand, and pricing strategies when setting optimal prices. In an age of widespread information availability and the ease at which consumers can shop and compare, setting the right price is more important than ever.

REFERENCES

Armstrong, Gary and Philip Kotler. Marketing: An Introduction, Fourteenth Edition, Pearson: Hoboken, NJ. 2020.

Lamb, Charles D., Joe F. Hair and Carl McDaniel. MKTG, Thirteenth Edition, Beaverton Ringold Inc. 2020.

Nagle, Thomas T. and Reed K. Holden. The Strategy and Tactics of Pricing: A Guide to Profitable Decision Making, Third Edition, Prentice Hall: Upper Saddle River, NJ. 2002.

Simon, Hermann and Martin Fassnacht. Price Management, Springer Nature: Cham, Switzerland. 2019.

Media Attributions

- 10

- Home for Sale Sign by Mark Moz, licensed under CC BY 2.0

- Skateboard via pxhere, licensed under CC0 Public Domain

- Extreme skateboarder via PIXNIO, licensed under CC0

- Graph by Z. Farley

- Razor blades via Wallpaper flare, licensed under CC0

- Graph by Z. Farley

- Tiffany Blue by Jill Clardy, licensed under CC BY-SA 2.0

One of the two main determinants of price. This determinant takes into consideration the costs incurred by the seller in setting the price

One of the two main determinants of price. This determinant considers what the target market is willing to buy at various price points

Costs that do not change with unit output

Costs that do change with unit output

Total variable costs = variable costs per unit ⨰ number of units

Total costs = variable costs + fixed costs

Occurs when the total costs equal the total revenue

Break even volume = fixed costs / (price – variable cost)

The amount coming into the firm when considering the price and the number of units sold

Total revenue = price × number of units

The remaining balance from the revenue brought in after subtracting total costs

Profit = total revenue – total costs

The share of the price that adds to profit

Contribution margin = price – variable cost

The number of units the market will buy at given price points within a time period

A measure of the extent of change in demand given a change in price

When the marketer considers the costs to make the product available to the customer and adds a mark-up value when setting the final price

Occurs when the marketer sets the price high when a product is first introduced to capitalize on customers who want the product as soon as it hits the market

Occurs when the marketer sets the price low when a product is first introduced to get people to try the product before the price is raised to its regular price

A situation in which the base product is relatively inexpensive, however, the supplementary or replacement parts are needed to be purchased in order for the product to work

Prices that change and are not constant over a period of time

When a product is priced purposefully higher to elicit perceptions of extremely high quality or luxury