17.2 Accounting: More than Numbers

Lawrence J. Gitman, et al

Prior to 2001, accounting topics rarely made the news. That changed when Enron Corp.’s manipulation of accounting rules to improve its financial statements hit the front pages of newspapers. The company filed bankruptcy in 2001, and its former top executives were charged with multiple counts of conspiracy and fraud. Arthur Andersen, Enron’s accounting firm, was indicted and convicted of obstruction of justice, and in 2002, the once-respected firm went out of business. Soon financial abuses at other companies—among them Tyco, Adelphia, WorldCom, and more recently Madoff Investment Securities—surfaced. Top executives at these and other companies were accused of knowingly flouting accepted accounting standards to inflate current profits and increase their compensation. Many were subsequently convicted:

- Investment securities broker Bernard Madoff and his accountant bilked investors out of more than $65 billion; Madoff is currently serving a 150-year prison term.

- Andrew Fastow, Enron’s former chief financial officer, and Ben Glisan Jr., its former treasurer, pleaded guilty and received prison terms of 10 and five years, respectively. The company’s former chairman, Ken Lay, and CEO, Jeffrey Skilling, were convicted of multiple charges.

- Bernard Ebbers, WorldCom’s CEO, was sentenced to 25 years in prison for conspiracy, securities fraud, and filing false reports with regulatory agencies—crimes that totaled $11 billion in accounting fraud.

- Tyco’s CEO L. Dennis Kozlowski was fined $70 million and sentenced to 8 to 25 years.

These and other cases raised critical concerns about the independence of those who audit a company’s financial statements, questions of integrity and public trust, and issues with current financial reporting standards. Investors suffered as a result because the crisis in confidence sent stock prices tumbling, and companies lost billions in value.

So it’s no surprise that more people are paying attention to accounting topics. We now recognize that accounting is the backbone of any business, providing a framework to understand the firm’s financial condition. Reading about accounting irregularities, fraud, audit (financial statement review) shortcomings, out-of-control business executives, and bankruptcies, we have become very aware of the importance of accurate financial information and sound financial procedures.

All of us—whether we are self-employed, work for a local small business or a multinational Fortune 100 firm, or are not currently in the workforce—benefit from knowing the basics of accounting and financial statements. We can use this information to educate ourselves about companies before interviewing for a job or buying a company’s stock or bonds. Employees at all levels of an organization use accounting information to monitor operations. They also must decide which financial information is important for their company or business unit, what those numbers mean, and how to use them to make decisions.

This chapter starts by discussing why accounting is important for businesses and for users of financial information. Then it provides a brief overview of the accounting profession and the post-Enron regulatory environment. Next it presents an overview of basic accounting procedures, followed by a description of the three main financial statements—the balance sheet, the income statement, and the statement of cash flows. Using these statements, we then demonstrate how ratio analysis of financial statements can provide valuable information about a company’s financial condition. Finally, the chapter explores current trends affecting the accounting profession.

Accounting Basics

Accounting is the process of collecting, recording, classifying, summarizing, reporting, and analyzing financial activities. It results in reports that describe the financial condition of an organization. All types of organizations—businesses, hospitals, schools, government agencies, and civic groups—use accounting procedures. Accounting provides a framework for looking at past performance, current financial health, and possible future performance. It also provides a framework for comparing the financial positions and financial performances of different firms. Understanding how to prepare and interpret financial reports will enable you to evaluate two companies and choose the one that is more likely to be a good investment.

The accounting system shown in Figure 17.3 converts the details of financial transactions (sales, payments, purchases, and so on) into a form that people can use to evaluate the firm and make decisions. Data become information, which in turn becomes reports. These reports describe a firm’s financial position at one point in time and its financial performance during a specified period. Financial reports include financial statements, such as balance sheets and income statements, and special reports, such as sales and expense breakdowns by product line.

Who Uses Financial Reports?

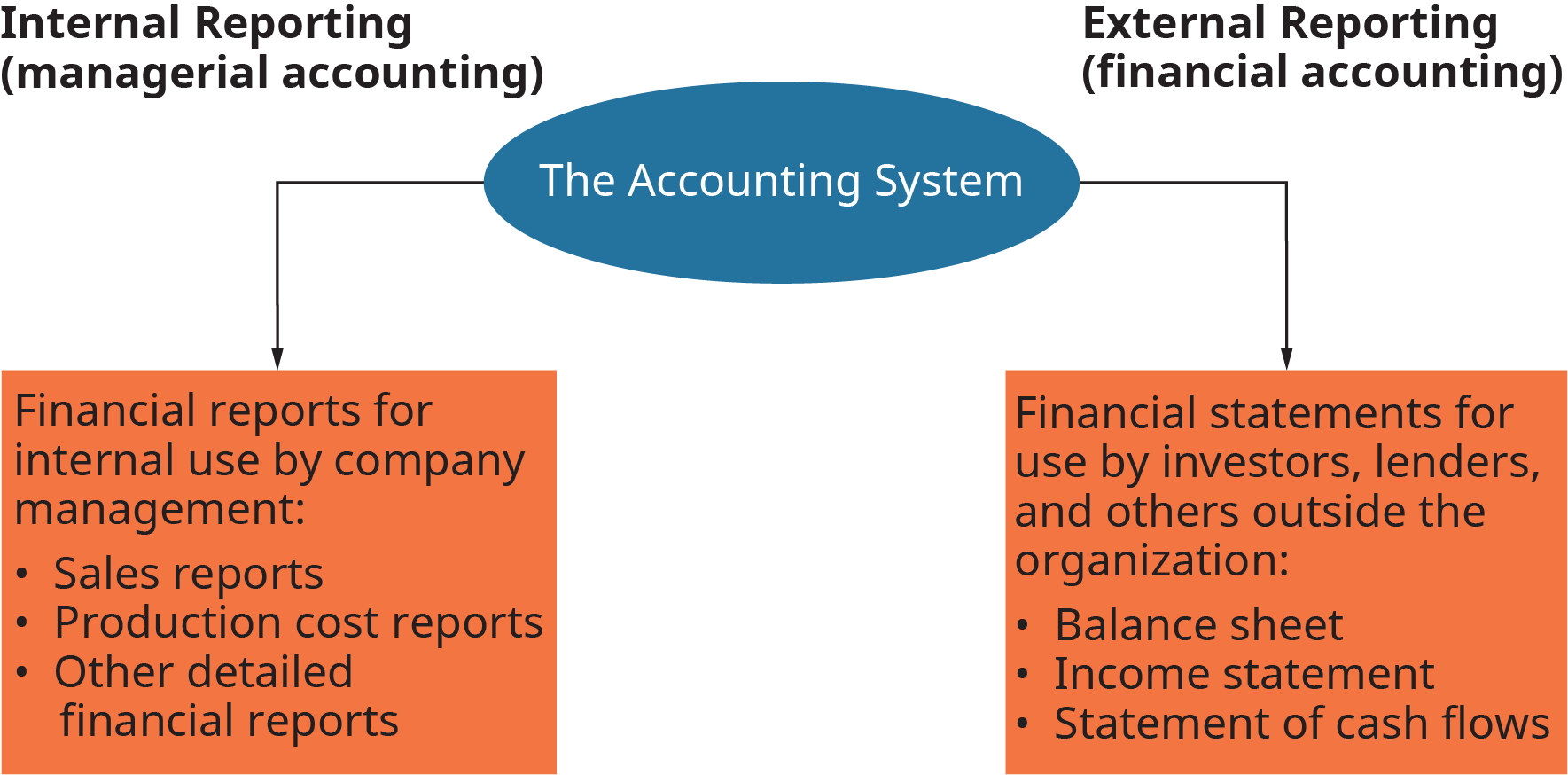

The accounting system generates two types of financial reports, as shown in Figure 17.4 internal and external. Internal reports are used within the organization. As the term implies, managerial accounting provides financial information that managers inside the organization can use to evaluate and make decisions about current and future operations. For instance, the sales reports prepared by managerial accountants show how well marketing strategies are working, as well as the number of units sold in a specific period of time. This information can be used by a variety of managers within the company in operations as well as in production or manufacturing to plan future work based on current financial data. Production cost reports can help departments track and control costs, as well as zero in on the amount of labor needed to produce goods or services. In addition, managers may prepare very detailed financial reports for their own use and provide summary reports to top management, providing key executives with a “snapshot” of business operations in a specific timeframe.

Financial accounting focuses on preparing external financial reports that are used by outsiders; that is, people who have an interest in the business but are not part of the company’s management. Although they provide useful information for managers, these reports are used primarily by lenders, suppliers, investors, government agencies, and others to assess the financial strength of a business.

To ensure accuracy and consistency in the way financial information is reported, accountants in the United States follow generally accepted accounting principles (GAAP) when preparing financial statements. The Financial Accounting Standards Board is a private organization that is responsible for establishing financial accounting standards used in the United States.

Currently there are no international accounting standards. Because accounting practices vary from country to country, a multinational company must make sure that its financial statements conform to both its own country’s accounting standards and those of the parent company’s country. Often another country’s standards are quite different from U.S. GAAP. In the past, the U.S. Financial Accounting Standards Board and the International Accounting Standards Board (IASB) worked together to develop global accounting standards that would make it easier to compare financial statements of foreign-based companies. However, as of this writing, the two organizations have not agreed on a global set of accounting standards.

Financial statements are the chief element of the annual report, a yearly document that describes a firm’s financial status. Annual reports usually discuss the firm’s activities during the past year and its prospects for the future. Three primary financial statements included in the annual report are discussed and shown later in this chapter:

- The balance sheet

- The income statement

- The statement of cash flows

Global Accounting Standards Unlikely to Happen

Imagine being a CFO of a major multinational company with significant operations in 10 other countries. Because the accounting rules in those countries don’t conform to GAAP, your staff has to prepare nine sets of financial reports that comply with the host country’s rules—and also translate the figures to GAAP for consolidation into the parent company’s statements in the United States. It’s a massive undertaking for anyone.

The U.S. FASB and the IASB have tried to make this task easier, but progress has been slow. These groups hoped to develop international accounting standards that remove disparities between national and international standards, improve the quality of financial information worldwide, and simplify comparisons of financial statements across borders for both corporations and investors. Unfortunately, it looks like this goal of convergence is slipping away.

More than a decade ago, the FASB and the IASB jointly published a memorandum of understanding (MOU) reaffirming the two organizations’ desire to create uniform global accounting standards. “This document underscores our strong commitment to continue to work together with the IASB to bring about a common set of accounting standards that will enhance the quality, comparability, and consistency of global financial reporting, enabling the world’s capital markets to operate more effectively,” said Robert Herz, FASB’s former chairman. Sir David Tweedie, then chairman of the IASB, agreed: “The pragmatic approach described in the MOU enables us to provide much-needed stability for companies using IFRS [the IASB’s International Financial Reporting Standards] in the near term,” he commented. (About 150 countries worldwide currently use IFRS.)

As they worked toward convergence, the board members decided to develop a new set of common standards rather than try to reconcile the two standards. These new standards had to be better than existing ones, not simply eliminate differences. Unfortunately, merging GAAP and IFRS into a consistent set of international accounting standards has proven to be very difficult because of different approaches used in the two sets. For example, because of frequent litigation surrounding financial information in the United States, preparers of financial statements demand very detailed rules in all areas of accounting, in contrast to the IASB’s approach of setting accounting principles and leaving preparers to apply them to individual situations they encounter. In addition, many companies doing business in the United States fear that moving toward global accounting standards would be very costly and time-consuming in terms of changing accounting software, employee and vendor training, and other business-related practices.

For now, the two organizations agree to disagree on when and if they can “converge” GAAP and IFRS into a global set of standards. However, they continue to keep each other informed about upcoming changes in standards that may impact accounting practices worldwide.

Critical Thinking Questions

- Is it important to have a single set of international accounting standards for at least publicly owned companies? Defend your answer.

- Do you think the two organizations will ever come close to uniform global accounting standards? Use a search engine and the archives of CFO magazine, http://www.cfo.com, to research this topic, and summarize your findings.

Sources: “Who Uses IFRS Standards?” http://www.ifrs.org, accessed August 10, 2017; “FASB and IASB Reaffirm Commitment to Enhance Consistency, Comparability and Efficiency in Global Capital Markets,” (press release), http://www.fasb.org, accessed August 10, 2017; Ken Tysiac, “Will Brexit, Trump Affect Global Accounting Standards?” http://www.journalofaccountancy.com, December 6, 2016; Bruce Cowie, “Insights: IFRS/US GAAP Convergence and Global Accounting Standards—Where Are We Now?” https://kaplan.co.uk, September 26, 2016; Michael Cohn, “IASB and FASB Look Beyond Convergence,” https://www.accountingtoday.com, December 9, 2014; David M. Katz, “The Split over Convergence,” CFO, http://ww2.cfo.com, October 17, 2014.

Key Takeaways

- Accounting involves collecting, recording, classifying, summarizing, reporting, and analyzing a firm’s financial activities according to a standard set of procedures.

- The financial reports resulting from the accounting process give managers, employees, investors, customers, suppliers, creditors, and government agencies a way to analyze a company’s past, current, and future performance.

- Financial accounting is concerned with the preparation of financial reports using generally accepted accounting principles. Managerial accounting provides financial information that management can use to make decisions about the firm’s operations.

Exercises

- Explain who uses financial information.

- Differentiate between financial accounting and managerial accounting.

- How do GAAP, the FASB, and the IASB influence the accounting industry?

References

Sneha Shah, “10 Biggest Recent Accounting Scandals in America,” http://www.insidermonkey.com, March 27, 2017

Pat Wechsler, “This CEO Spent Nearly 7 Years in Jail. Now He’s Helping Ex-Cons,” Fortune, http://fortune.com, February 16, 2016

Joseph Ax, “Ex-Accounting Executive Avoids Prison in Madoff Fraud Case,” Reuters, http://www.reuters.com, July 9, 2015

Scott Cohn, “Former Enron Executive Jeffrey Skilling Moved to Minimum-Security Prison,” CNBC, https://www.cnbc.com, January 9, 2014

financial statement review

process of collecting, recording, classifying, summarizing, reporting, and analyzing financial activities

sales, payments, purchases,

provides financial information that managers inside the organization can use to evaluate and make decisions about current and future operations

focuses on preparing external financial reports that are used by outsiders; that is, people who have an interest in the business but are not part of the company’s management

To ensure accuracy and consistency in the way financial information is reported

is a private organization that is responsible for establishing financial accounting standards used in the United States

a yearly document that describes a firm’s financial status.